Prepaid Digital Value vs Bank Money: What’s the Difference?

Money has changed. What we once understood strictly as “bank money” is now sharing space with prepaid digital value systems that operate outside traditional banking infrastructure. At first glance, both may look similar because both are used digitally. In reality, they function very differently, especially in terms of access, control, privacy, and real-world usability.

This article breaks down the difference between prepaid digital value and bank money in simple, human language, supported by real experience, modern fintech principles, and practical examples.

What Is Bank Money?

Bank money is value stored and managed by a financial institution. When you deposit funds into a bank account, the bank records your balance on its internal ledger. Every transaction you make depends on that institution’s approval, rules, and operating hours.

Bank money requires identity verification, geographic compliance, and ongoing institutional trust. While it offers familiarity, it also introduces friction, fees, and delays that many users experience daily.

What Is Prepaid Digital Value?

Prepaid digital value represents value that is loaded in advance and stored digitally without relying on a bank account. It exists inside digital wallets or secure systems and can be transferred directly between users.

To understand the mechanics better, this guide on how digital value moves without traditional banks explains why prepaid systems operate independently from legacy finance.

A Real Human Experience

When I first started using a prepaid digital value platform on September 15, 2024, it honestly felt boring. I loaded value, looked around, and left it untouched for weeks. I treated it like a backup, not a solution.

On November 12, I faced an urgent financial situation where bank delays and restrictions became painfully obvious. That was when I realized I had been using the platform the wrong way. Once I understood how prepaid value, digital wallets, and secure access worked together, it became my number one option whenever speed and reliability mattered.

Control: Who Really Owns the Value?

With bank money, the institution controls access. Accounts can be frozen, transactions delayed, or services limited. With prepaid digital value, control shifts to the user through access credentials rather than institutional permission.

This difference becomes clearer when using secure wallet systems like those explained in how digital wallet vaults work.

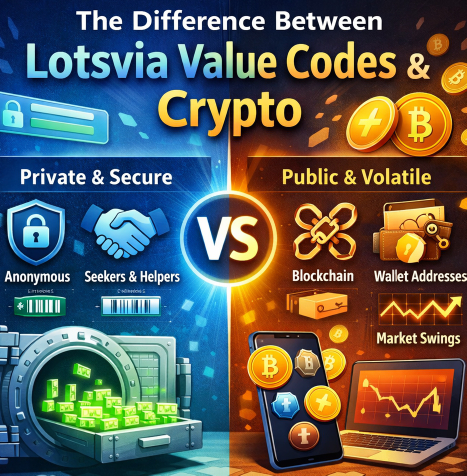

Privacy and Data Exposure

Bank money requires extensive personal data. Every transaction strengthens a financial profile. Prepaid digital value systems minimize this exposure by design, focusing on value movement rather than identity tracking.

This privacy-first approach is detailed in anonymous digital value transfer protection.

Speed and Availability

Bank transfers often depend on business hours, clearance windows, and intermediaries. Prepaid digital value moves instantly within its ecosystem, regardless of time or location.

This is why prepaid systems are increasingly preferred in urgent or time-sensitive situations.

Digital Wallets as the Bridge

Digital wallets store prepaid value securely and allow direct transfers. Unlike bank apps, they are not merely interfaces to institutional accounts. They are independent value containers.

If you are new to wallets, this digital wallet guide explains the fundamentals clearly.

Value Codes vs Bank Transfers

Prepaid digital value often uses value codes. These codes represent stored value and can be shared securely. The process is explained in how digital value codes work.

Compared to bank transfers, value codes offer flexibility and privacy without exposing account details.

Security Differences

Bank security relies on centralized systems. Prepaid digital value relies on encryption, access control, and wallet architecture. A deeper explanation is available in what makes a digital wallet truly secure.

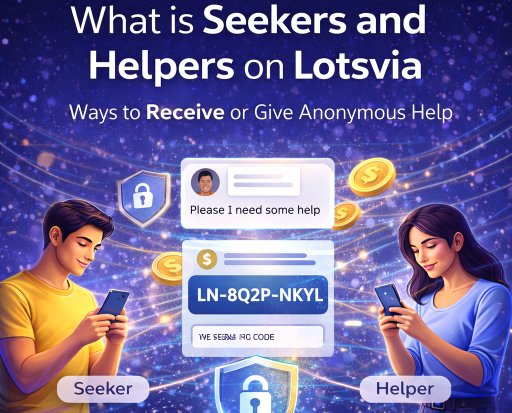

Seekers and Helpers: A Human Layer

One unique aspect of prepaid digital value systems is the seeker-helper dynamic. Seekers receive value directly, while helpers provide assistance without friction or institutional delay.

This relationship is explained fully in the seekers and helpers model.

Common Mistakes to Avoid

Using prepaid digital value incorrectly can reduce its benefits. Common errors include poor credential storage, misunderstanding redemption rules, or ignoring documentation.

Helpful resources include common value code mistakes and advanced usage errors.

Bank Money Still Has a Role

This comparison is not about eliminating banks. Bank money remains useful for regulated services like loans, payroll, and long-term savings. The difference is that prepaid digital value fills gaps banks cannot.

Why Financial Access Is Shifting

The shift away from exclusive bank dependence is explained in why financial access is replacing bank accounts. Users want control, speed, and dignity.

External Perspectives

Global institutions like the World Bank on financial inclusion and NIST cybersecurity standards recognize digital value systems as essential tools for inclusive finance.

Final Thoughts

Prepaid digital value and bank money serve different purposes. Bank money offers structure and regulation. Prepaid digital value offers access, speed, and flexibility. From personal experience, understanding this difference changed how I manage financial needs.

When used correctly, prepaid digital value is not a replacement for banks. It is a powerful alternative that gives users choice, control, and confidence in modern financial life.