Nuclear SMR Stocks to Watch as AI Energy Demand Explodes

The conversation around Nuclear SMR stocks has changed dramatically in recent years, and in 2026 it is being reshaped by one powerful force: AI energy demand. Data centers running large language models, autonomous agents, and real-time analytics are consuming unprecedented amounts of electricity. Traditional power sources are struggling to keep up, and this is where Small Modular Reactors (SMRs) are stepping into the spotlight.

This guide explains, in clear and practical terms, why Nuclear SMR stocks are gaining attention, how AI energy demand is driving this trend, and which companies investors are watching closely. The goal is education and clarity, not hype. If you are curious about where energy, AI, and long-term infrastructure investing intersect, this article is for you.

Why AI Energy Demand Is Reshaping the Global Power Market

AI is no longer just software running quietly in the background. Today’s AI systems require massive computing power, and that computing power translates directly into electricity consumption. Hyperscale data centers now operate 24/7, drawing as much power as small cities.

AI energy demand is different from traditional industrial demand. It is constant, highly sensitive to outages, and expected to grow for decades. This reliability requirement is one reason energy planners are reconsidering nuclear power, especially SMRs, which offer stable baseload energy.

As someone who has followed fintech and infrastructure trends closely, it feels similar to watching digital payments replace cash. Just as financial access is replacing bank accounts, explained clearly in this article on financial access, energy access for AI is replacing old assumptions about power generation.

What Makes Small Modular Reactors (SMRs) Different

Traditional nuclear plants are massive, expensive, and slow to build. SMRs, on the other hand, are smaller, factory-built, and designed for scalability. This makes them attractive in a world shaped by fast-growing AI energy demand.

SMRs can be deployed near data centers, industrial hubs, or remote regions. Their modular nature allows energy providers to add capacity gradually instead of committing billions upfront.

From an investor’s perspective, Nuclear SMR stocks represent exposure to infrastructure that aligns with long-term AI growth rather than short-term tech cycles.

How AI Companies Are Quietly Supporting Nuclear SMR Growth

Major AI and cloud companies rarely talk loudly about nuclear investments, but actions speak louder than press releases. Long-term power purchase agreements, pilot projects, and policy lobbying all point in the same direction.

AI firms need predictable pricing and uninterrupted power. SMRs offer exactly that. This is similar to how digital platforms prefer secure value systems, as explained in this guide on secure digital wallets.

When you connect these dots, it becomes clear why AI energy demand and Nuclear SMR stocks are increasingly mentioned together.

Nuclear SMR Stocks to Watch in 2026

While this is not investment advice, several companies consistently appear in discussions around SMR deployment and commercialization.

- NuScale Power: One of the most recognized names in SMR development, with regulatory milestones already achieved.

- Oklo: Focused on compact reactors designed specifically for data centers and industrial users.

- Rolls-Royce SMR: Leveraging engineering expertise to target both government and private-sector energy needs.

- Cameco: While not an SMR builder, uranium suppliers benefit indirectly from rising AI energy demand.

Investors watching Nuclear SMR stocks often look beyond hype and focus on licensing progress, partnerships, and balance sheet strength.

Risk Factors Every Investor Should Understand

Despite the optimism, SMRs are not risk-free. Regulatory delays, public perception, and cost overruns remain real challenges.

Just as users must avoid errors when handling digital value systems, highlighted in this article on common mistakes, investors must understand the operational risks tied to nuclear projects.

Understanding these risks is essential before committing capital to Nuclear SMR stocks.

AI Energy Demand vs Renewable Energy

Renewables like solar and wind are important, but they are intermittent. AI systems cannot pause operations when the sun sets or the wind stops.

This is why many experts see SMRs as complementary rather than competitive. Nuclear provides the stable baseline, while renewables reduce marginal costs.

This layered approach mirrors how digital value moves without traditional banks, as described in this explanation of value transfer.

Policy and Government Support for SMRs

Governments in the US, UK, and parts of Asia are accelerating SMR approvals due to national security and energy independence concerns.

As AI energy demand becomes a strategic issue, policy support is increasingly aligned with nuclear innovation.

This environment creates long-term tailwinds for well-positioned Nuclear SMR stocks.

How Individual Investors Can Approach This Sector

For individual investors, patience is key. SMRs are infrastructure plays, not quick trades.

Consider diversification, regulatory timelines, and whether exposure comes through builders, suppliers, or energy utilities.

This disciplined mindset mirrors best practices in digital finance, such as understanding how value codes work step by step, explained in this detailed guide.

What we have discussed so far

- Nuclear SMR stocks

- AI energy demand

- Small modular reactors investment

- AI data center power supply

- Nuclear energy for AI

- SMR nuclear companies

- Future of nuclear energy

- AI infrastructure energy

- Clean energy for data centers

- Next generation nuclear stocks

Conclusion: A Long-Term Infrastructure Story

The rise of AI energy demand is not a temporary trend. It is reshaping how the world thinks about power generation. In this context, Nuclear SMR stocks represent a bridge between advanced technology and dependable infrastructure.

For investors willing to learn, wait, and manage risk, this sector offers a compelling narrative grounded in real-world needs rather than speculation.

Related Topics

- Anonymous digital value transfer and privacy

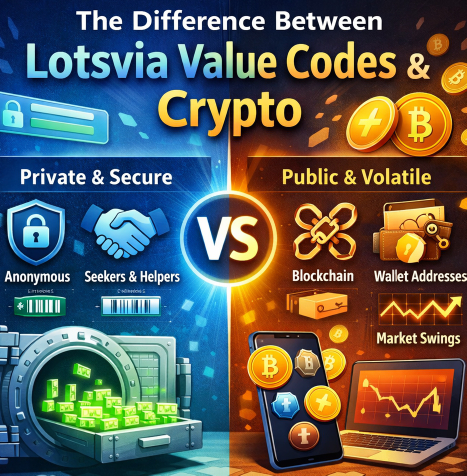

- Difference between value codes and crypto

- How digital wallets really work

- Prepaid digital value vs bank money

- Agentic AI ROI in 2026