Bonds vs Cash 2026: Why Holding Too Much Cash May Hurt Returns

In 2026, investors are asking an increasingly critical question: Bonds vs Cash 2026, which allocation makes the most sense in a post-inflation world? Holding too much cash might feel safe, like keeping your money under the mattress (minus the dust bunnies), but it can quietly erode purchasing power over time. This guide explores why, with real examples, humor, and actionable insights, helping you navigate post inflation investing without losing sleep.

Cash seems comforting, right? You see the balance, you know it’s liquid, and unlike the rollercoaster of the stock market, it doesn’t scream at you every day. But in a world where inflation is still lingering and interest rates are slowly adjusting, cash can become a silent thief, quietly eating your returns. Enter bonds: a classic investment that can offer stability, income, and protection against this subtle erosion.

Understanding Cash in 2026: Is Your Money Really Safe?

Cash in a high-inflation or post-inflation environment is like having ice cream in the sun. You might enjoy it now, but over time it melts — in this case, your purchasing power. Interest rates may rise, but they often fail to fully compensate for inflation, leaving your hard-earned money losing value. Post inflation investing requires a strategic mindset: balancing liquidity with growth potential.

Think about it this way: keeping $100,000 in a checking account that earns 0.5% when inflation runs 3% is equivalent to losing $2,500 of value a year. Not catastrophic overnight, but it adds up, silently undermining your long-term goals. Compare that to bonds that might earn 4-5% per year — suddenly, your money is at least trying to run with inflation, not lag behind.

Bonds vs Cash 2026: The Core Differences

Let’s break it down like a friendly neighborhood finance class. Here’s what makes bonds different from cash:

- Liquidity: Cash is king for instant needs. Bonds can be liquid, but depending on maturity and type, cashing in early may incur losses.

- Returns: Cash yields near-zero to low interest. Bonds provide predictable income, often outpacing inflation if selected carefully.

- Risk: Cash is low risk nominally but loses value to inflation. Bonds carry credit and interest rate risk but may hedge inflation better.

- Growth potential: Bonds generally provide better long-term growth than cash, especially in post inflation investing scenarios.

To illustrate, imagine you’re a cat sitting on your cash pile. Comfortable? Sure. But as the economy shifts, inflation paws at your pile, nibbling at the edges. Bonds, on the other hand, offer a small mouse of return, but it grows over time, helping you keep ahead of inflation. Yes, finance analogies can involve cats.

Why Too Much Cash Can Hurt Your Returns

Excess cash leads to opportunity cost. By keeping money idle, you miss out on potential bond income, dividend-paying investments, or strategic growth allocations. Even ultra-conservative investors can optimize by holding a mix that protects against both volatility and inflation.

Consider the historical perspective: after high inflation periods in the 1970s and early 1980s, investors who held cash saw purchasing power decline, while bondholders gradually recouped value as interest rates normalized. Bonds vs Cash 2026 continues to be shaped by this very principle — careful positioning can protect you from silently losing wealth.

Types of Bonds to Consider in 2026

Not all bonds are created equal. Picking the right bond type matters:

- Government bonds: Low risk, moderate return, excellent for inflation protection.

- Corporate bonds: Higher yield, slightly more risk; careful selection is key.

- Municipal bonds: Tax advantages, useful for investors in high-tax regions.

- Inflation-protected bonds (TIPS): Directly adjust for inflation, ideal in post inflation investing strategies.

Strategically diversifying across these types can protect your portfolio against both unexpected inflation spikes and prolonged low-rate environments. It’s like spreading your snacks across multiple lunchboxes; if one gets raided by inflation, others survive.

Liquidity Considerations: Why Cash Isn’t Always King

Liquidity is the main advantage of cash. But in 2026, high liquidity may not justify opportunity cost. Short-term cash cushions remain important, but a significant portion should be allocated toward bonds or other interest-bearing instruments.

For example, you might keep 3-6 months of living expenses in cash for emergencies, while allocating 30-50% of the rest toward high-quality bonds. This is similar to how digital value codes are secured in secure digital wallets, providing both accessibility and protection.

Risk vs Return: Finding Your Balance

Every investor has a different risk tolerance. Cash offers minimal risk but low returns, while bonds carry moderate risk but higher potential returns. Your ideal mix depends on your goals, timeframe, and market outlook.

Humor helps here: Think of cash as a safety helmet, and bonds as a pair of running shoes. The helmet protects you, but you’re not going anywhere fast. The shoes expose you to minor scrapes, but you reach your destination faster.

Inflation, Interest Rates, and the 2026 Context

2026 is unique because the world is adjusting to post-pandemic economic shifts, lingering inflation, and central bank strategies. Interest rates may rise slowly, meaning cash yields remain low relative to potential bond returns.

Investors ignoring this dynamic may miss out on post inflation investing opportunities, leaving cash as a silent drag on returns. Bonds provide a structured way to stay ahead of inflation without venturing into high-risk territories.

Practical Tips for Allocating Between Bonds and Cash

- Emergency fund: Keep 3-6 months in cash for unforeseen events.

- Bond laddering: Stagger maturities to balance interest rate risk and liquidity.

- High-quality selection: Focus on government and corporate bonds with strong credit ratings.

- Monitor inflation: Adjust allocations as post-inflation expectations evolve.

- Reinvest returns: Compound interest in bonds beats idle cash over time.

Following these practices allows a portfolio to stay flexible while minimizing risk — a lot like keeping digital value moving efficiently without relying on traditional banks, as described in this guide.

Behavioral Insights: Why We Hold Too Much Cash

Many investors hold excess cash due to fear, habit, or overconfidence in liquidity. Yet, behavioral finance suggests this “comfort cash” can actually reduce long-term returns, especially in post inflation investing scenarios.

A light-hearted analogy: keeping cash under your pillow feels safe, but your future self might wake up to find inflation has stolen the blanket!

Interactive Strategy: Test Your Allocation

Try this simple exercise: for a hypothetical $100,000 portfolio, allocate:

- Cash: 20% ($20,000)

- Government Bonds: 50% ($50,000)

- Corporate Bonds & TIPS: 30% ($30,000)

Track the performance over a year assuming 2% inflation and 4% average bond return. Even a conservative mix of bonds significantly outpaces cash, illustrating why Bonds vs Cash 2026 decisions are critical.

Case Study: Post Inflation Investing Success

Investor A kept 80% cash in 2025, earning minimal interest. Investor B held 50% in government bonds and 30% in TIPS. After 12 months, Investor B’s portfolio outperformed by 3-4% in real terms — a small but meaningful edge that compounds over years.

This mirrors lessons from other value systems, such as secure handling of digital wallets explained in this article. Strategy and structure matter more than inertia.

External Considerations and Market Outlook

Global factors such as central bank policy, economic growth, and AI-driven energy demand influence real returns. While bonds cannot completely eliminate risk, they provide a structured way to maintain purchasing power.

As markets adapt, smart investors will adjust cash holdings to optimize real returns without taking on undue risk, similar to how investors monitor AI-driven infrastructure and Nuclear SMR stocks.

Conclusion: Striking the Right Balance in 2026

Holding too much cash in 2026 can silently erode your portfolio, even if it feels safe. Bonds vs Cash 2026 is ultimately about balance: maintain enough liquidity for emergencies, but allocate meaningfully to bonds to protect and grow your wealth in a post-inflation world.

Smart post inflation investing combines knowledge, discipline, and strategy — with a dash of humor to survive the financial rollercoaster.

Related Topics

- Anonymous digital value transfer and privacy

- Seekers and helpers explained

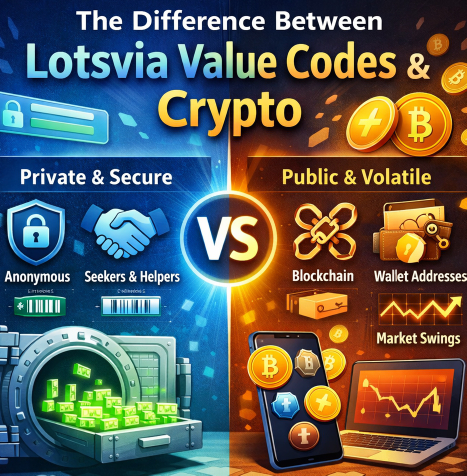

- Difference between value codes and crypto

- Generating and redeeming value codes securely

- Common mistakes in digital value usage