How Digital Value Moves Without Traditional Banks

For decades, banks were the primary gatekeepers of money movement. Sending, receiving, or storing value almost always required a bank account, identity verification, and centralized approval. Today, financial technology has changed that reality. Digital value can now move securely without relying on traditional banks, opening new paths for financial inclusion, privacy, and accessibility.

This article explains, in simple language, how digital value moves outside the banking system, why this shift matters, and how seekers and helpers play a role in modern digital value ecosystems. Whether you are new to fintech or simply curious, this guide is designed to give you clarity, not complexity.

What Is Digital Value?

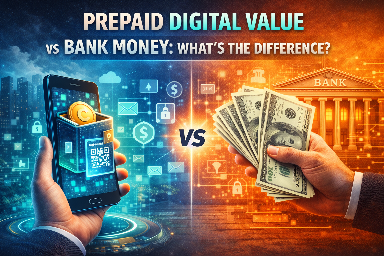

Digital value refers to electronically stored value that can be transferred between people or systems without physical cash. Unlike traditional bank money, digital value does not always require a bank account to exist or move. It can live inside digital wallets, prepaid systems, or secure value containers designed specifically for modern online use.

Digital value is not the same as speculative assets or investment products. It is primarily designed for utility: sending help, receiving support, paying for services, or storing value safely for later use.

Why Traditional Banks Are No Longer the Only Option

Banks provide important financial services, but they also come with limitations. Account requirements, geographic restrictions, fees, and delays can make banking inaccessible for many people. In some regions, millions remain unbanked or underbanked despite having access to the internet and mobile devices.

Digital value systems emerged to address these gaps. They allow people to move value directly, without waiting for bank approvals or navigating complex financial structures.

How Digital Value Moves Without Banks

At the core of non-bank digital value movement is a simple principle: value is represented digitally and transferred through secure systems rather than bank ledgers. These systems rely on technology, encryption, and predefined rules instead of centralized banking intermediaries.

- Value is stored digitally, not in a bank account

- Transfers occur within a closed or semi-open system

- Ownership is proven through access, not identity

- Transactions are recorded for integrity, not surveillance

The Role of Digital Wallets

A digital wallet is a secure software-based container that holds digital value. Unlike a bank account, a digital wallet does not necessarily represent a personal identity. Instead, it represents access to value.

Digital Wallets enable users to store, send, receive, and manage value independently. Security mechanisms such as encryption, access controls, and transaction verification protect the value held inside.

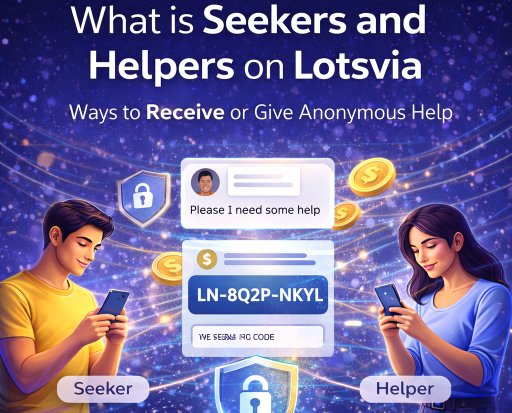

Understanding Seekers and Helpers

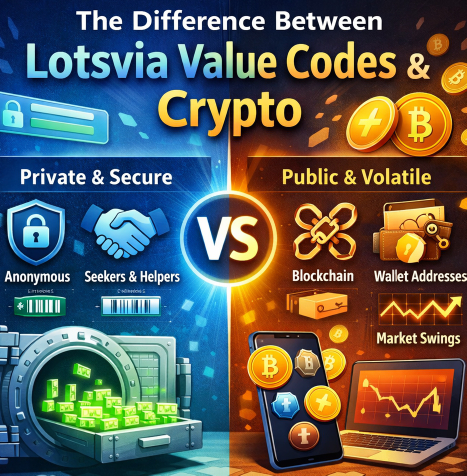

One of the most human-centered aspects of digital value systems is the concept of seekers and helpers. This framework focuses on purpose-driven value movement rather than profit-driven transactions.

A seeker is someone who needs value. This could be assistance, support, or temporary access to resources. A helper is someone willing to provide value, often anonymously or without traditional financial friction.

How Seekers Participate

Seekers can receive digital value without needing a bank account. They do not need to disclose personal financial history or pass credit checks. Access is based on receiving valid digital value, not proving eligibility to an institution.

How Helpers Contribute

Helpers can send value directly, knowing it will reach its destination without being delayed or altered by intermediaries. This direct connection encourages trust, transparency, and timely support.

Privacy and Control in Digital Value Systems

Traditional banking systems collect extensive personal data. Digital value systems often minimize data exposure by design. Transactions focus on value movement, not personal profiling.

This approach protects both seekers and helpers. Privacy is preserved, and control remains with the user rather than a centralized authority.

Security Without Centralization

Security in non-bank digital value systems does not rely on a single institution. Instead, it uses layered protection mechanisms such as encryption, transaction validation, and controlled access environments.

This decentralized security model reduces single points of failure and increases resilience against misuse or unauthorized access.

Transparency Without Exposure

While privacy is preserved, transparency still exists. Systems can track value movement without revealing personal identities. This balance ensures accountability without sacrificing dignity or autonomy.

Why This Matters for Financial Inclusion

Digital value movement without banks empowers individuals who have been excluded from traditional finance. It provides access, not dependency. People can participate in economic activity without meeting rigid institutional criteria.

This shift supports humanitarian assistance, peer support, and global collaboration across borders and systems.

Common Misunderstandings

- Digital value is not always speculative or volatile

- Non-bank systems can still be secure and reliable

- Privacy does not mean lack of accountability

- Accessibility does not mean lack of structure

The Future of Non-Bank Value Movement

As technology evolves, digital value systems will continue to mature. They are likely to coexist with traditional banks rather than replace them entirely. The goal is choice, flexibility, and inclusion.

Seekers and helpers will remain central to this evolution, reminding us that finance is ultimately about people, not institutions.

Understanding these systems today prepares individuals, communities, and organizations for a future where financial access is not limited by geography, paperwork, or legacy infrastructure.