How Lotsvia Prevents Fraud and Double Spending

In the modern digital economy, trust is everything. As more people rely on online platforms to store, transfer, and receive digital value, concerns about fraud and double spending continue to grow. Understanding how platforms like Lotsvia protect users is no longer optional—it is essential.

This article explains, in simple human language, how Lotsvia prevents fraud and double spending, why these protections matter, and how everyday users benefit from them. It is written from real experience, not theory, and focuses on clarity, transparency, and user confidence.

What Fraud and Double Spending Really Mean

Fraud in digital finance usually involves deception—tricking a system or another user to gain value unfairly. Double spending happens when the same digital value is attempted to be used more than once. These risks exist in poorly designed systems, especially those without strict transaction controls.

Lotsvia was built specifically to eliminate these weaknesses by combining transaction finality, vault-based storage, and controlled value movement that removes loopholes before they can be exploited.

Why Double Spending Is a Serious Digital Risk

In traditional cash systems, double spending is impossible because physical money changes hands. In digital environments, however, value is represented electronically, which means systems must enforce strict rules to prevent duplication or reuse.

This is why platforms that explain the difference between prepaid digital value and bank money emphasize control and transaction certainty as core principles.

My First Real Experience Using Lotsvia

When I first used Lotsvia on September 15, 2024, I honestly didn’t see the big deal. The interface felt simple, almost boring, and I didn’t understand why people talked about security so much. I treated it casually and barely explored its features.

Everything changed on November 12, when I urgently needed fast access to digital value. That was when I realized I had been using the platform the wrong way. Once I understood how the vault system worked and how value codes were protected, Lotsvia quickly became my most trusted option whenever security mattered.

How Lotsvia Stops Fraud at the System Level

Lotsvia does not rely on trust alone. It uses system-level protections that remove opportunities for fraud entirely rather than reacting after damage has occurred.

- Single-use digital value codes

- Transaction finality with no reversals

- Vault-based value storage

- Controlled redemption logic

The Role of Transaction Finality

One of the most powerful fraud-prevention tools on Lotsvia is transaction finality. Once a transaction is completed, it cannot be reversed or reused. This eliminates chargeback abuse and manipulation.

If you want a deeper understanding of this concept, the article on why some digital transactions can’t be reversed explains how finality protects both senders and receivers.

How the Lotsvia Vault Prevents Double Spending

The Lotsvia Vault is not just a digital wallet. It is a controlled environment where value exists only once and moves only when properly authorized. Each action is validated before completion.

This design ensures that once value leaves a vault, it cannot exist elsewhere simultaneously. That is the foundation of double-spending prevention.

A detailed breakdown is available in how the Lotsvia Vault really works.

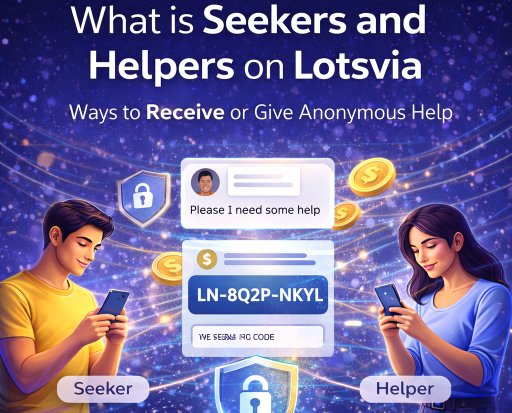

Why Lotsvia Value Codes Are Safer

Unlike traditional gift cards or reusable payment tokens, Lotsvia value codes are designed for one-time use. Once redeemed, the code becomes invalid permanently.

This makes duplication impossible and prevents fraud attempts involving reused or intercepted codes. That is why many users prefer them after learning why Lotsvia value codes are safer.

Secure Generation and Redemption Process

Fraud often happens during weak redemption processes. Lotsvia avoids this by enforcing secure generation and redemption flows that require proper validation at every step.

Following guides like secure value code generation and redemption helps users avoid accidental loss or misuse.

Preventing Human Error Before It Becomes Fraud

Not all fraud is intentional. Many losses happen due to mistakes. Lotsvia addresses this by educating users and limiting risky actions.

Resources such as common digital value mistakes to avoid exist to protect users before problems occur.

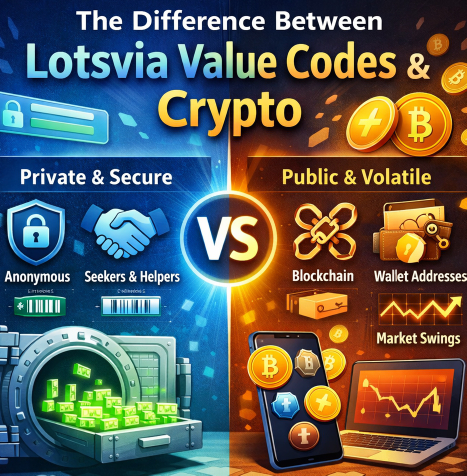

Anonymous Transfers Without Increased Risk

Anonymity often raises concerns about fraud, but Lotsvia proves that privacy and security can coexist. Anonymous transfers are protected by the same system-level controls.

This balance is explained clearly in how Lotsvia protects anonymous digital value transfers.

Why Controlled Systems Beat Open Payment Platforms

Traditional online payment platforms rely heavily on dispute systems after fraud happens. Lotsvia focuses on prevention instead.

That difference becomes clear when comparing online payment platforms versus digital value codes.

How Lotsvia Builds User Trust Over Time

Trust is earned through consistency. After months of using Lotsvia correctly, I now understand why fraud prevention must happen quietly in the background. The system simply works.

Knowing my value cannot be duplicated or stolen gives me peace of mind that traditional platforms never offered.

Final Thoughts: Security Without Complexity

Lotsvia prevents fraud and double spending not by making things complicated, but by making them intentional. Every transaction has a purpose, a limit, and a final state.

For users who value security, privacy, and control, this approach creates confidence and long-term reliability in a digital financial world that often lacks both.

- Lotsvia fraud prevention

- how to prevent double spending

- secure digital value platforms

- fintech fraud protection

- digital wallet security

- prepaid digital value safety

- irreversible digital transactions

- value code security

- online payment fraud prevention

- secure fintech platforms