Online Payment Platforms vs Digital Value Codes: What’s Better?

The digital economy is growing fast and offering new ways for people to pay, send, or receive value. But not all solutions are built the same. Two commonly talked‑about technologies are online payment platforms — like PayPal or mobile wallets — and digital value codes, which are unique codes representing stored value. Each has distinct advantages, security considerations, user scenarios, and business benefits. This guide breaks down the differences, so you can understand which option fits your needs best.

What Are Online Payment Platforms?

An online payment platform is a digital system that enables electronic transfers of money between users, merchants, and banks through a secure internet connection. These platforms allow payments, peer‑to‑peer transfers, recurring billing, and checkout processes for online commerce. Web‑based payment services act as intermediaries between your bank or card and the merchant, ensuring funds are transferred safely. 0

- Examples: PayPal, Stripe, Apple Pay, Google Pay, Blik.1

- Support credit and debit cards, bank transfers, QR payments, digital wallets interfaces.2

- Often integrate payment gateways for merchants.3

How Online Payment Platforms Work

Users register with a platform, link a bank account or card, and authenticate their identity. During a transaction, the platform securely transmits payment data between parties, often using encryption and fraud detection systems. 4

- Customer enters payment details or chooses stored payment method.

- Platform securely authorizes the transaction.

- Funds move from payer to merchant or receiver. Instant or settlement occurs as supported.

What Are Digital Value Codes?

Digital value codes are unique alphanumeric strings that represent a stored monetary amount or value you can redeem for goods, services, or transfers. They work similarly to gift card codes, prepaid vouchers, or digital coupons — and are frequently used for both consumer convenience and fintech services. 5

Unlike platforms that connect directly to bank accounts, digital value codes act as a standalone token of value that can be given, redeemed, or exchanged without immediately involving banking credentials.

- Examples include prepaid voucher codes, e‑gift cards, and platform specific value codes.6

- Often purchased with cash or digital payment and redeemed via code input.7

Digital Value Codes in Practice

These codes are generated once value is added and can then be shared or redeemed online. Many Fintech services, including LOTSVIA, use secure code systems to let users transfer value directly to others (“seekers and helpers”) without disclosing banking details. (See Seekers and Helpers on LOTSVIA)

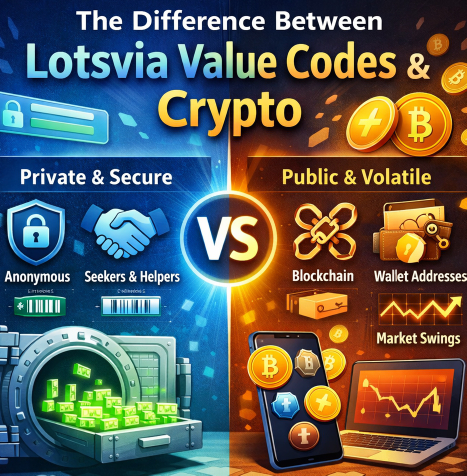

Key Differences: Platforms vs Value Codes

1. Transaction Flow

- Online Payment Platforms process payments by connecting accounts or cards through secure gateways. They handle authorization, settlement, and often refunds or disputes.8

- Digital Value Codes represent preloaded funds that transfer value only when the code is redeemed. No live banking connection is required during redemption.9

2. Accessibility

- Platforms require accounts, linked credentials, and identity verification.

- Value Codes can be shared easily with minimal onboarding — sometimes without formal accounts. (Refer: Anonymous Digital Value Transfer on LOTSVIA)

3. Use Case Examples

- Platforms: Online shopping checkout, subscriptions, peer‑to‑peer transfers.

- Codes: Gifts, rewards, one‑time transfers, incentives, prepaid services.

Benefits for Users (Seekers)

Both systems provide value, but their benefits vary by use case:

- Convenience: Platforms streamline payments across merchants and services globally.10

- Privacy: Value codes let seekers receive funds without revealing personal financial data. (See How LOTSVIA Value Codes Work)

- Speed: Online platforms often handle transactions in real‑time or near real‑time.11

- Accessibility: Value codes are useful for unbanked users or those without linked payment methods.12

Benefits for Businesses (Helpers)

- Reduced Payment Friction: Platforms allow merchants to accept many payment types, improving conversions.13

- Promotions & Rewards: Value codes can be used as digital promotions, loyalty rewards, or gift options.

- Lower Chargebacks: Prepaid codes often reduce disputes and refunds since funds are preloaded. (See Why LOTSVIA Value Codes Are Safer)

- Broader Reach: Platforms enable global transactions and cross‑border payments.14

Security Considerations

Security is paramount in digital finance. Both online payment platforms and digital value codes implement strong security strategies, but the nature of risks differs:

- Online Platforms: Use encryption, multi‑factor authentication, and fraud monitoring. However, they remain targets for phishing or data breaches.15

- Digital Value Codes: Minimize exposure of bank or card data, but lose value if codes are shared insecurely — so secure redemption and storage are key (see Secure Generation & Redemption).

When to Choose Which Option?

Online Payment Platforms Are Better If:

- You need continuous payments, regular subscriptions, or merchant checkout functionality.

- You want integrated fraud protection, refunds, and transaction history reporting.16

- You frequently shop online or pay bills across multiple services.

Digital Value Codes Are Better If:

- You want anonymous or private value exchange without linking financial accounts.

- You are sending a gift, reward, or prepaid value that doesn’t require live account access.

- You are targeting unbanked or privacy‑focused users.17

Common Mistakes to Avoid

Both systems require careful use for safe outcomes. Avoid these pitfalls:

- Sharing codes over insecure channels (text, social media) without additional verification. (See Common Mistakes with Digital Codes)

- Using unverified payment platforms — check for SSL/TLS, PCI‑DSS compliance, and reviews.18

- Ignoring transaction records or alerts, which help detect unexpected activity early.

Conclusion

Both online payment platforms and digital value codes play important roles in the modern Fintech landscape. Platforms excel in broad payment coverage, international use, and merchant integration, while value codes shine for privacy, prepaid value distribution, and ease of sharing value across users without exposing financial details.

Your choice depends on what matters most — convenience and integration (platforms), or privacy and value‑centric transfers (codes). Many smart Fintech strategies combine both to create seamless and flexible payment ecosystems.