-network-knowledge-base/” style=”color:#1e73be; text-decoration:underline;”>Wallet-network-knowledge-base

how it is transforming financial transactions. Comprehensive guide for beginners and experts in Fintech.”>

What Is a Digital Wallet and How Does It Work?

In today’s fast-paced world, digital wallets have emerged as a revolutionary way to manage money, make transactions, and simplify payments. But what exactly is a digital wallet, how does it work, and why is it becoming increasingly popular among users and businesses alike? This comprehensive guide will answer all your questions in clear, easy-to-understand language.

Understanding Digital Wallets

A

digital wallet (also known as an e-wallet or mobile wallet) is a software-based system that securely stores users’ payment information and passwords for numerous payment methods and websites. It allows individuals to make electronic transactions quickly and safely, both online and in-person, without the need for physical cash or cards.

Key Components of a Digital Wallet

- Payment Information: Stores credit/debit card numbers, bank account details, and other payment credentials.

- User Authentication: Uses passwords, PINs, biometrics (fingerprint or facial recognition) to secure access.

- Transaction Processing: Handles secure transfer of funds during purchases or money transfers.

- Integration with Services: Works with retail stores, online marketplaces, mobile apps, and financial institutions.

Pro Tip: Digital wallets are not just convenient—they reduce the risk of carrying cash and can offer added layers of security, including encryption and fraud detection.

How Digital Wallets Work

Digital wallets function through secure software that connects your payment methods to merchants or service providers. Here’s a step-by-step overview:

Step 1: Setting Up Your Wallet

Users first download a digital wallet app or access a wallet integrated with banking or e-commerce platforms. Popular examples include

Apple Pay, Google Wallet, PayPal, and Samsung Pay. Once installed, you can link your bank account, debit or credit card, or even cryptocurrency wallets.

Step 2: Authentication and Security

Before making transactions, digital wallets require verification through

PINs, passwords, or biometric authentication. Advanced wallets also offer two-factor authentication (2FA) to prevent unauthorized access.

Step 3: Making Payments

Digital wallets support multiple payment methods:

- Near Field Communication (NFC): Tap your phone or device at a contactless payment terminal.

- QR Code Payments: Scan a merchant’s QR code or have the merchant scan your code.

- Online Payments: Use the wallet to complete online purchases without manually entering card details.

Step 4: Transaction Processing

When a transaction is initiated, the wallet encrypts the payment data and communicates securely with your bank or payment provider. The funds are transferred to the recipient, and both parties receive confirmation instantly.

Step 5: Record Keeping and Management

Digital wallets store a transaction history, allowing users to track spending, monitor balances, and manage multiple payment methods in one place. Many wallets also integrate budgeting or rewards features for smarter financial management.

Did You Know? Digital wallets can even store loyalty cards, tickets, boarding passes, and identification documents, making them a versatile tool beyond payments.

Benefits of Using Digital Wallets

Digital wallets offer numerous advantages to both users and businesses:

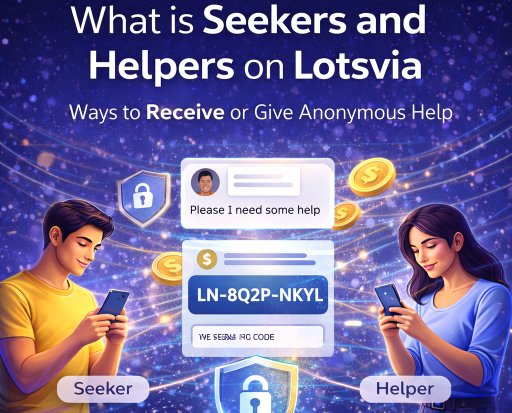

For Users (Seekers)

- Convenience: Pay with a tap or scan without carrying cash or cards.

- Security: Advanced encryption and tokenization keep financial information safe.

- Budgeting: Track spending and manage multiple accounts effortlessly.

- Rewards & Offers: Many wallets provide cashback, loyalty points, or discounts.

- Accessibility: Available on smartphones, smartwatches, and other devices, making payments seamless anytime.

For Businesses (Helpers)

- Faster Transactions: Reduce checkout time and enhance customer experience.

- Lower Fraud Risk: Secure digital payments reduce cash handling risks.

- Customer Insights: Access valuable data for personalized offers and marketing.

- Broader Reach: Accept digital payments from global customers without traditional banking hurdles.

- Cost-Effective: Reduce operational costs by minimizing cash handling and manual processing.

Types of Digital Wallets

Understanding the types of digital wallets helps users choose the right option for their needs:

1. Closed Wallets

Issued by a company to be used for purchasing its own goods or services only. Example: Retail store wallets.

2. Semi-Closed Wallets

Allow users to transact with multiple merchants within a specific network but cannot withdraw cash. Example: Paytm, Amazon Pay.

3. Open Wallets

Linked to bank accounts and allow both online and offline transactions. Users can withdraw cash as well. Example: Apple Pay, Google Wallet.

Security Measures in Digital Wallets

Security is the cornerstone of digital wallets. Here are key features that ensure safe transactions:

- Encryption: Sensitive data is encrypted to prevent unauthorized access.

- Tokenization: Replaces card details with unique digital tokens.

- Two-Factor Authentication: Adds an extra layer of security for access and transactions.

- Fraud Detection: AI and machine learning monitor unusual activity to prevent fraud.

- Remote Deactivation: Wallets can be disabled remotely if a device is lost or stolen.

Common Misconceptions About Digital Wallets

- Only for tech-savvy people: Most wallets are user-friendly and require minimal setup.

- Not secure: Digital wallets often have stronger security than traditional payment methods.

- Limited usage: Modern wallets support online, offline, and peer-to-peer transactions.

The Future of Digital Wallets

The digital wallet industry is growing rapidly, driven by trends like:

- Integration with AI: Smart recommendations, budgeting, and predictive spending insights.

- Cryptocurrency Support: Enabling users to hold and transact in digital currencies.

- Biometric Payments: Enhanced security and faster authentication using facial recognition and fingerprints.

- Global Adoption: Cross-border payments becoming seamless with digital wallets.

- Embedded Finance: Integration with lending, insurance, and investment services.

Expert Tip: For maximum efficiency, choose a digital wallet that aligns with your lifestyle, supports multiple merchants, and integrates with banking or financial management apps.

Conclusion

Digital wallets are transforming the way we manage money and make payments. They provide convenience, security, and a seamless transaction experience for users while offering businesses faster payments, reduced fraud risk, and valuable customer insights. Whether you are a casual shopper, a frequent traveler, or a business owner, understanding and using digital wallets can simplify financial management and enhance your digital finance experience.

With continuous innovation in Fintech, digital wallets are poised to become even more integral to everyday life, bridging the gap between traditional banking and modern, cashless payments.