What Makes a Digital Wallet Truly Secure

Security is the foundation of trust in modern financial technology. Without it, even the most advanced digital wallet becomes useless. I learned this lesson personally over time. When I first started using digital wallets, I focused on convenience and ignored security details. That changed completely after a real-world experience that reshaped how I view digital financial tools.

This guide explains, in clear and simple language, what truly makes a digital wallet secure, how users can protect themselves, and why security today is about access and design rather than traditional bank control.

What Is a Digital Wallet?

A digital wallet is a software-based system that stores digital value and allows users to send, receive, and manage it securely. Unlike bank accounts, many digital wallets are not tied to personal identity or physical institutions. If you are new to the concept, this guide on what a digital wallet is and how it works explains the basics clearly.

Digital wallets exist to provide access, speed, and flexibility. But those benefits only matter if security is built correctly from the ground up.

Why Digital Wallet Security Matters More Than Ever

As financial access replaces traditional bank accounts, digital wallets have become central to everyday transactions. This shift is explained further in why financial access is replacing bank accounts. With more value stored digitally, security is no longer optional.

A secure wallet protects not just money, but privacy, autonomy, and peace of mind.

My Personal Wake-Up Moment

When I started using a digital value platform on September 15, 2024, it felt boring. I only checked it occasionally and treated it like a backup tool. On November 12, everything changed. I needed urgent financial access, and suddenly I realized I had been using the platform the wrong way. I had ignored security settings, skipped documentation, and misunderstood how the wallet actually worked.

Once I took time to understand the system, especially how secure value storage and controlled access worked, it became my number one option whenever I needed reliable digital value movement.

Core Elements of a Truly Secure Digital Wallet

1. Strong Encryption

Encryption ensures that stored value and transaction data cannot be read or altered by unauthorized parties. Secure wallets use advanced cryptographic methods that protect data both at rest and in transit.

2. Controlled Access

Access control determines who can use the wallet. This may involve passwords, keys, or layered authorization systems. A wallet is only as secure as its access design.

3. Secure Storage Architecture

Modern wallets use isolated storage environments rather than centralized databases. This reduces the risk of mass breaches. Learn more through how a digital wallet vault works.

Privacy as a Security Feature

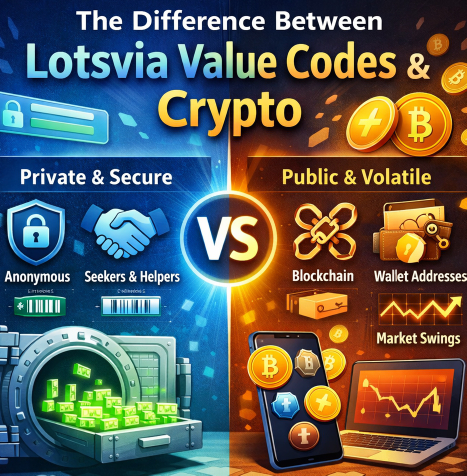

True security includes privacy. Platforms that support anonymous digital value transfer reduce exposure by design. Less stored personal data means fewer attack surfaces.

Privacy protects both seekers and helpers by limiting unnecessary data collection.

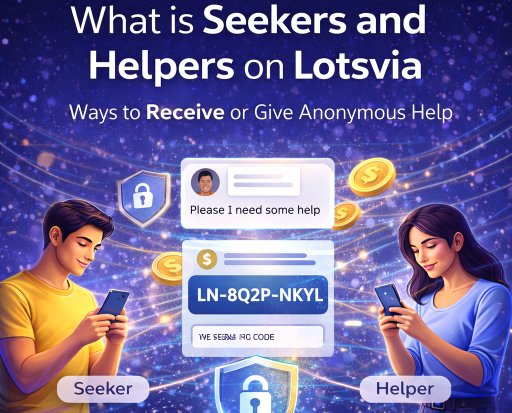

Seekers and Helpers in Secure Wallet Systems

Secure wallets often support purpose-driven interactions between seekers and helpers. If you are unfamiliar with this concept, this explanation of seekers and helpers provides clarity.

Security ensures seekers receive value safely and helpers can provide support without fear of misuse.

Digital Value Codes and Wallet Safety

Digital value codes add another layer of security by separating value from identity. Understanding how digital value codes work helps users avoid common mistakes.

When generated and redeemed correctly, as explained in secure value code usage, they offer flexibility without compromising safety.

Common Security Mistakes to Avoid

- Sharing access credentials

- Ignoring wallet documentation

- Failing to secure backup information

- Misunderstanding value code handling

These issues are detailed in common mistakes to avoid and advanced value code errors.

Digital Wallets vs Traditional Payment Platforms

Traditional online payment platforms rely heavily on centralized control. Secure digital wallets focus on user access and autonomy. This comparison is covered in online payment platforms vs digital value codes.

Wallet Security Across Networks

Network compatibility matters. Wallets operating on standards like BEP20 require network-level understanding. The BEP20 wallet knowledge base offers technical clarity for users.

Why Secure Wallets Are Replacing Bank Dependence

Digital wallets offer immediate access, fewer barriers, and user-controlled security. Combined with the ability to move value without banks, as described in how digital value moves without banks, wallets represent a practical evolution of finance.

External Perspectives on Wallet Security

Organizations like the National Institute of Standards and Technology and Cloudflare’s security learning center reinforce the importance of encryption, access control, and minimal data exposure in digital systems.

How Users Can Strengthen Wallet Security

- Understand how your wallet works

- Use platforms designed with privacy first

- Store access credentials securely

- Follow recommended usage practices

Final Thoughts

A truly secure digital wallet is not defined by marketing claims but by thoughtful design, responsible usage, and user education. My experience taught me that security is not boring. It becomes essential the moment you truly need reliable financial access.

When used correctly, secure digital wallets are not just tools. They are dependable partners in modern financial life.