Why Financial Access Is Replacing Bank Accounts

Traditional banking has long been the backbone of financial activity, but over the past decade, a shift has emerged. Many people no longer rely solely on bank accounts to store, send, or receive value. Instead, digital wallets and alternative financial systems now provide convenient, flexible, and inclusive solutions.

When I first explored LOTΣVIA in September 2024, I didn’t fully understand its potential. At first, it felt somewhat abstract and limited. However, by November 12, when I needed urgent financial assistance, I realized I had been using the platform incorrectly. Once I aligned with its functionality and features, I maximized its benefits, making it my preferred solution for managing value without traditional banks.

What Is Financial Access?

Financial access refers to the ability to participate in economic activity — sending, receiving, storing, and using value — without necessarily holding a traditional bank account. Systems designed around financial access leverage modern technology to enable secure, instant, and private value movement. These solutions often involve digital wallets, prepaid value codes, and platforms that connect seekers and helpers efficiently.

For example, using LOTΣVIA, you can send or receive digital value while minimizing personal data exposure, as detailed in their guide on anonymous digital value transfers.

Why Bank Accounts Are Losing Dominance

Bank accounts come with many limitations: geographical restrictions, strict verification processes, hidden fees, and processing delays. Millions worldwide remain unbanked or underbanked, even in regions with reliable internet access. Digital-first platforms, by contrast, provide flexibility, accessibility, and security without requiring users to interact with traditional banks.

For instance, digital value can move without traditional banks, ensuring instant transfers between wallets, regardless of location or bank involvement.

Digital Wallets: Empowering Users

Digital wallets are secure containers that store value digitally. Unlike bank accounts, they may not require formal identity verification and often allow anonymous or pseudonymous participation. Users can:

- Store value digitally and securely

- Send or receive funds instantly

- Interact with seekers and helpers in peer-to-peer contexts

- Redeem value codes safely

To learn more about the security of these wallets, LOTΣVIA provides an in-depth explanation in LOTSVIA Vault Explained.

Value Codes: A Flexible Alternative

Digital value codes are prepaid codes representing a certain amount of value. They function as a bankless payment tool but maintain security and privacy. Users can generate and redeem these codes safely as explained in how to generate and redeem LOTΣVIA value codes securely.

I remember generating a value code in late December 2024. Initially, I hesitated, thinking it would be complicated. However, after following the simple steps and redeeming it, I realized the potential of having bank-free, instant financial tools.

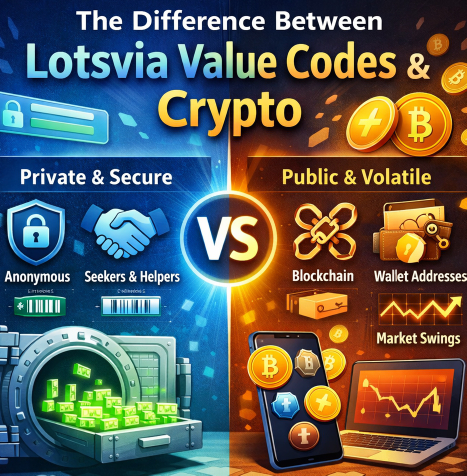

For further comparison between traditional digital finance tools and value codes, you can check the difference between LOTΣVIA value codes and crypto.

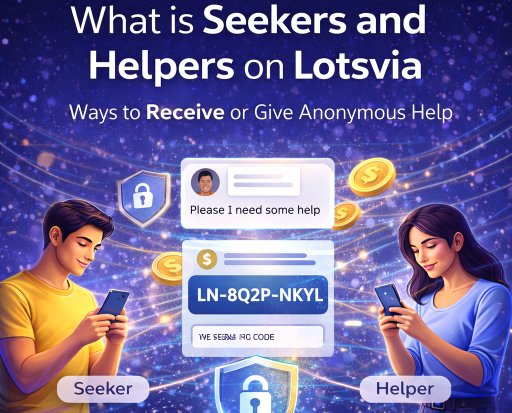

The Seeker and Helper Dynamic

A core feature of platforms emphasizing financial access is the interaction between seekers and helpers. Seekers are users in need of assistance or resources, while helpers provide value to support them. This human-centered model enables a direct, trust-based flow of value without banking intermediaries.

During my early LOTΣVIA experience, I acted both as a helper and a seeker. I quickly realized the platform’s efficiency and how the value moved seamlessly between participants. For details, see Seekers and Helpers on LOTΣVIA.

Benefits Over Traditional Bank Accounts

- Privacy: Minimal personal data exposure

- Speed: Near-instantaneous transfers

- Accessibility: Open to anyone with internet access

- Flexibility: Supports diverse use cases like assistance, gifting, or payments

- Lower costs: No hidden fees or account maintenance

Financial access platforms also provide educational tools for users. LOTΣVIA, for example, offers insights into common mistakes to avoid when using digital value codes and why LOTΣVIA value codes are safer than gift cards.

User Experience and Real-Life Insights

Let me share a personal experience: When I first used LOTΣVIA in September 2024, I mainly explored its wallet and value code features casually. By November, during an unexpected financial need, I realized I had underutilized the platform. After fully engaging with its seeker-helper framework and understanding how digital value moves without banks, it became my go-to option for urgent financial transactions.

The human-centered design ensures users feel secure while learning how to maximize financial tools. For example, the step-by-step guide on how LOTΣVIA value codes work helped me understand exactly how to generate, send, and redeem value safely.

Common Pitfalls to Avoid

Even with financial access platforms, mistakes happen. Users should avoid:

- Ignoring security protocols for wallets or codes

- Sharing private information unnecessarily

- Attempting to misuse seeker-helper systems

- Overlooking guides like common mistakes when using LOTΣVIA value codes

The Future of Financial Access

The movement towards financial access over traditional accounts is accelerating. Technologies like digital wallets, value codes, and secure peer-to-peer networks create a new paradigm. As more people adopt these solutions, bank-centric limitations decrease, fostering financial inclusion globally.

Platforms that focus on privacy, speed, and human usability, such as LOTΣVIA, exemplify this trend. Additionally, resources like BEP20 Wallet Network Knowledge Base and Online Payment Platforms vs Digital Value Codes provide further education on navigating these systems effectively.

Conclusion

Financial access is transforming the way individuals interact with money. Digital wallets, value codes, and human-centered systems like seeker-helper networks allow people to move, store, and use value without relying solely on bank accounts. From personal experience, embracing these tools provides freedom, privacy, and efficiency.

If you want to explore this further, LOTΣVIA’s full guides on bank-free digital value movement and digital wallet operation are excellent starting points.

The shift from bank accounts to financial access isn’t just a technology trend; it’s a human-centric revolution designed to make finance more inclusive, private, and responsive to real-world needs.